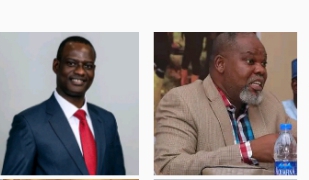

Nigeria Leading Development Expert, Ale, Write FG, Chairman, Presidential Committee On Fiscal Policy And Tax Reforms, Oyedele

A prominent development expert Micheal Ale on Tuesday said Mr Taiwo Oyedele’s comparison of Nigeria’s budget with those of Kenya and South Africa is incomplete.

Ale in a rejoinder sent to Nigerian Alert stated that it is inadequate to reference only budget size without a comprehensive review of other development indices.

He added that budgets alone do not drive national progress adding that countries like South Africa and Kenya Oyedele cited have integrated environmental, social, and economic sustainability into their development strategies.

“Development is holistic and requires careful balancing of resources with social and environmental considerations.

Ale, who is also a water expert n response to the recent comments made, in a media publication, by Mr. Taiwo Oyedele, Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, concerning Nigeria’s tax reform and budget size, said he was compelled to address some of the issues raised by the Chairman.

“While Mr. Oyedele’s expertise in fiscal matters is acknowledged, his conclusions and recommendations appear narrow and fail to consider critical factors that drive sustainable development.

“In nations like the UK and the USA, for example, high budgets are accompanied by clear plans for sustainable development. These plans are not limited to fiscal policies but also address social safety nets, environmental resilience, and inclusive growth. Nigeria should adopt a similar integrated approach, rather than rushing into tax reforms that exacerbate the poverty trap.

“The Pitfalls of Rushed Tax Reforms

While tax reforms are vital, their timing and implementation are equally important. The current tax reform agenda risks plunging more Nigerians into poverty, as increased taxes on businesses ultimately shift the financial burden to consumers, disproportionately affecting the poor. This approach contradicts the principles of equitable and inclusive development.

“Instead of implementing aggressive tax policies, the government should focus on creating an enabling environment for businesses and individuals. Affordable taxation should be prioritized, with progressive tax strategies that ensure the wealthy bear more responsibility while the poor are protected.

“Leveraging Corporate Social Responsibility for Development

“Rather than overburdening the populace with taxes, the government can engage private sector actors in meaningful development. For example, large corporations should be incentivized to contribute to social infrastructure projects, as seen in other nations. Facilities like the O2 Arena in the UK, built by private corporations as part of their social responsibility, serve as excellent examples of how private-sector engagement can yield public benefits while generating revenue for the government.

“Reforming Budgeting and Development Planning

“The real issue lies in the lack of coherent development planning. Many budgets at both the national and sub-national levels are created without reference to a well-defined development framework. This haphazard approach undermines effective implementation and results in stagnated development.

“The Federal Government should:

1. Reform the National Budget and Planning department at all levels.

2. Strengthen monitoring and evaluation (M&E) systems to track progress and ensure accountability.

3. Engage independent development consultants or aggregators to validate and guide project outcomes.

Even the most substantial budget allocations will fail without these structural changes. It is not the amount spent on infrastructure that matters, but how these funds are utilized and their impacts evaluated.

“Final Thoughts and Recommendations

To achieve sustainable development, Nigeria must:

• Delay tax reforms until the socioeconomic environment is better prepared.

• Shift focus to creating a socially inclusive and environmentally sustainable development strategy.

• Prioritize affordable taxation and incentivize private-sector contributions to social infrastructure.

• Adopt and implement comprehensive development plans with measurable outcomes, supported by robust M&E mechanisms.

National development is far more complex than fiscal policies and budgetary expansions. A holistic approach that integrates environmental, social, and economic considerations will ensure that every naira spent translates into meaningful progress for all Nigerians.”

Micheal ALE

CEO, Global Initiative for Nigeria Development.